-

Premier Business FinanceOUR FOCUSWe focus in providing flexible products tailored to

Premier Business FinanceOUR FOCUSWe focus in providing flexible products tailored to

meet our customers unique funding requirements.

Our four funding pillars enable us to find solutions

to customers funding requirements that they may

well not have considered.OUR CUSTOMERSWe specialise in dealing with well-established

SME’s, corporates and institutions, with our prime

objective being to provide appropriate funding

solutions for all our customers.OUR GROUPURL Corporate Holdings Limited (“URL Group”)

is an Irish based group of companies that

specialises in providing structured finance

solutions across four pillars, namely:-

- Rental Finance (leasing)

- Invoice Finance (invoice discounting)

- Trade Finance

- Premium FinanceMany years of providing financial services -

Premier Business FinanceOUR FOCUSWe focus in providing flexible products tailored to

Premier Business FinanceOUR FOCUSWe focus in providing flexible products tailored to

meet our customers unique funding requirements.

Our four funding pillars enable us to find solutions

to customers funding requirements that they may

well not have considered.OUR CUSTOMERSWe specialise in dealing with well-established

SME’s, corporates and institutions, with our prime

objective being to provide appropriate funding

solutions for all our customers.OUR GROUPURL Corporate Holdings Limited (“URL Group”)

is an Irish based group of companies that

specialises in providing structured finance

solutions across four pillars, namely:-

- Rental Finance (leasing)

- Invoice Finance (invoice discounting)

- Trade Finance

- Premium FinancePremier Business Finance -

Premier Business FinanceOUR FOCUSWe focus in providing flexible products tailored to

Premier Business FinanceOUR FOCUSWe focus in providing flexible products tailored to

meet our customers unique funding requirements.

Our four funding pillars enable us to find solutions

to customers funding requirements that they may

well not have considered.OUR CUSTOMERSWe specialise in dealing with well-established

SME’s, corporates and institutions, with our prime

objective being to provide appropriate funding

solutions for all our customers.OUR GROUPURL Corporate Holdings Limited (“URL Group”)

is an Irish based group of companies that

specialises in providing structured finance

solutions across four pillars, namely:-

- Rental Finance (leasing)

- Invoice Finance (invoice discounting)

- Trade Finance

- Premium FinanceWe Care About Your Business -

Premier Business FinanceOUR FOCUSWe focus in providing flexible products tailored to

Premier Business FinanceOUR FOCUSWe focus in providing flexible products tailored to

meet our customers unique funding requirements.

Our four funding pillars enable us to find solutions

to customers funding requirements that they may

well not have considered.OUR CUSTOMERSWe specialise in dealing with well-established

SME’s, corporates and institutions, with our prime

objective being to provide appropriate funding

solutions for all our customers.OUR GROUPURL Corporate Holdings Limited (“URL Group”)

is an Irish based group of companies that

specialises in providing structured finance

solutions across four pillars, namely:-

- Rental Finance (leasing)

- Invoice Finance (invoice discounting)

- Trade Finance

- Premium FinanceUnparalleled Services

RENTAL FINANCE

INVOICE FINANCE

TRADE FINANCE

Premium Finance

Generally, the purchase of expensive equipment is most efficiently funded through some form of asset finance.

Rental agreements or off-balance sheet financing allows the customer to own the use of the technology, not the technology itself with the added benefits of upgradability and maintenance.

Rental agreements are suitable for businesses using equipment with either a high obsolescence or which require replacement on a regular basis.

Rental packages can be customised for various industries and offer many advantages for the customer, making this form of finance highly attractive.

Customer Advantages include:

- Off- balance sheet financing.

- Corporation tax benefits. The monthly rental payments are fully deductible as an expense for corporation tax purposes.

- Tailor made payment structures to suit the customer’s monthly cashflows.

- A complete practical financial solution – hardware, service and maintenance. A one stop shop.

- The VAT on a rental is raised on the monthly payment and is not capitalised “up front” as with Finance Leases or Bank funding. This results in a saving of finance charges.

- Improvement of the customer’s “Gearing Ratio”.

- No initial large cash outlay. Monthly cash flow can be accurately planned for the duration of the rental agreement.

- Alternative utilisation of the customer’s cash reserves, for working capital or business growth, becomes available.

- No fixed asset register entries or depreciation and wear and tear cost calculations and entries necessary.

- Rent to Own – At termination of the rental period, the customer has the option to acquire the asset.

Invoice finance is the umbrella term for a type of funding that provides fast access to cash tied in one’s outstanding customer invoices. It’s an alternative solution to traditional types of business finance and is much more flexible than an overdraft or loan.

With our invoice finance product, invoice discounting, the customer maintains responsibility for managing collections, so the facility is entirely confidential.

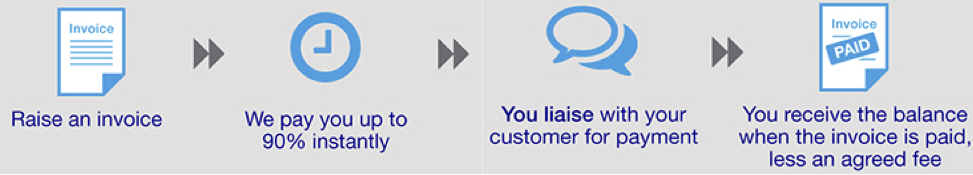

How does invoice discounting work?

All you have to do is raise the invoice and we’ll advance you up to 90% of the cash owed to you straight away, enabling you to keep your business moving without waiting to be paid.

When your customer settles the invoice, the remaining percentage is returned to you, less an agreed fee.

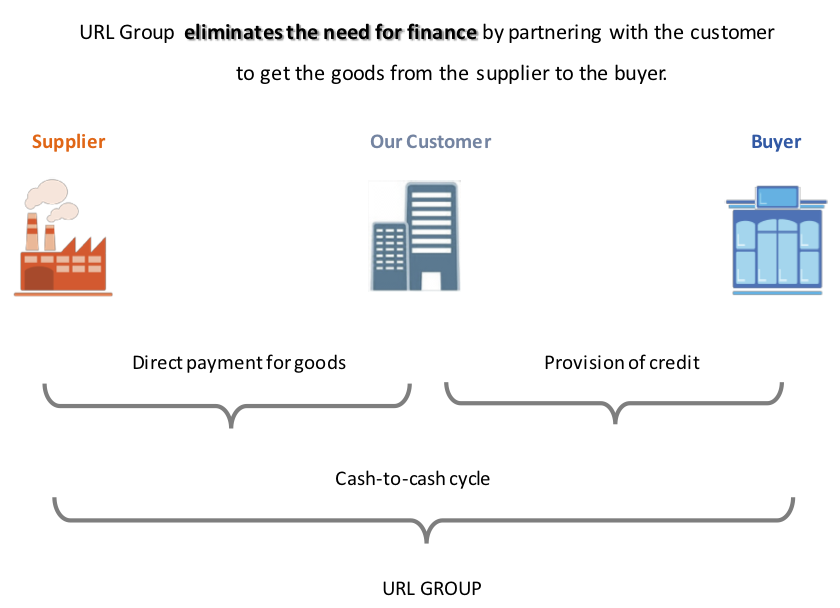

Trade finance is a type of business funding, which is typically purchase order driven and helps release working capital into a business.

This type of finance is built on the premise that buyers want to pay for goods as late as possible, and suppliers want payment as early as possible. Bridging this finance gap, and instigating trust between both parties, is the job of a trade finance provider.

What is Trade Finance?

Funding that allows you to make purchases and pay suppliers before you’ve received the cash from the sale.

Why pick Trade Finance?

It’s the perfect fit when needing to pay a supplier up front to fulfill a large sales order or opportunity.

How does it work?

We pay the supplier on your behalf, so you get the goods. Then you pay us back when you make the sale.

Instead of paying your insurance policy upfront in one lump sum, premium finance allows you to spread the insurance cost over regular instalments, allowing you more flexibility and cash flow management.

Helping to make insurance more affordable by spreading the cost through premium finance

We provide finance to you through your insurance broker, so you don’t have to pay upfront for your insurance premium. Spreading the cost of your insurance premium, enables you to pay for your insurance in a convenient and affordable way.

How premium finance works

If you decide to pay by premium finance, the set-up process couldn’t be easier. Once your insurance broker arranges your insurance policy, you sign a finance agreement with us. We pay your broker the full cost of your insurance premium. You then pay us back the cost of your insurance premium plus interest and any charges, in regular installments by Direct Debit.

WHAT WE BELIEVE IN

Know Your Customer

We work closely together in partnership. This enables us to fully understand the customers' business, then give them the best impartial advice and find the best funding solution.

Honesty and Integrity

This is at the core of everything we do. Always respecting confidential and sensitive credit information we may be provided with. We see the value of long-term customer retention. Our focus has always been on repeat business.

Expertise

We believe that our dedicated team of experienced personnel is our greatest asset. Our personnel are all experts in their field, passionate, responsible and diligent. Our customer care is paramount and that is why we strive to deliver a top-class service to all.

Flexible Products

We find solutions to customers’ funding requirements that they may well not have considered, as well as the traditional rental finance, invoice finance and trade finance options.

Proud not to be Centralised or Systems Driven

We pride ourselves on our personal touch. At the URL Group you deal with 'people' not a system. At a time when so many lenders are centralising and relying more and more on systems to run their businesses, we are the opposite. This means our customers benefit from a true 'personal 'touch. Nothing is too much trouble. Our goal is, through understanding of our customers, to develop close bonds that benefit both parties in the long term, resulting in superior relationships.

We are available to assist you with your financial requirements!

Our mission is to provide our customers with a personal service level, which consistently exceeds their expectations. This is achieved through combining all our experience and expertise to make the URL Group the premier financier that everyone wants to deal with in the SME, corporate and institutional sector.

About Our Company

The URL Group was established in May 2014 where originally, only rental finance (equipment leasing) was offered. In 2018 the group expanded its product range by offering its customers invoice finance, trade finance and most recently premium finance. The business was very fortunate to commence trading with a highly experienced team, who has many years of experience in asset finance and financial services. These experts in their respective fields, are all skilled, highly motivated, focused and operate with a real “can do” attitude . This expertise sets us apart from many other lenders and has been an important factor in the early success of the group. The URL Group’s prime objective is to provide appropriate funding solutions for all their customers.

Many years of experience

Very happy clients

100% satisfaction

MEET OUR TEAM

Grant Halcomb

Managing Director

Grant has more than twenty years’ experience in asset-based finance and financial services. He was the financial director of United Technologies (Pty) Ltd, a leasing company in South Africa prior to him moving to Ireland. Grant has held various other key financial roles in both private and listed companies and has sat on the boards of both Irish and South African companies. Grant is a qualified accountant.

Noel Quinn

Director

Noel Quinn recently joined the board of directors of the URL Group. Noel is a multiple business founder with a - FAIBF SERIAL ENTREPRENEUR 2023-Accreditation, as well as a partner and coach of the world’s most applied method for continuity and growth: BITSING Noel is an experienced international entrepreneur who has more than 30 years of business experience in the property, construction, technology and coaching and training sectors. Noel has been involved in startups, building, and the running of companies. Noel has extensive business experience in Ireland, the UK, Russia, and CIS countries. Noel brings a unique perspective (through his experience) on issues and challenges that companies face daily. Noel will assist with the raising of funding lines for the business and the long-term strategy of the business.

We are your Financial Solution.

Feel free to contact us

CONTACT US

Unit 2A, M4 Business Park Celbridge, Co. Kildare W23 PW2K

CALL US

+353 4 525 8022

EMAIL US

info@unitedrentals.ie